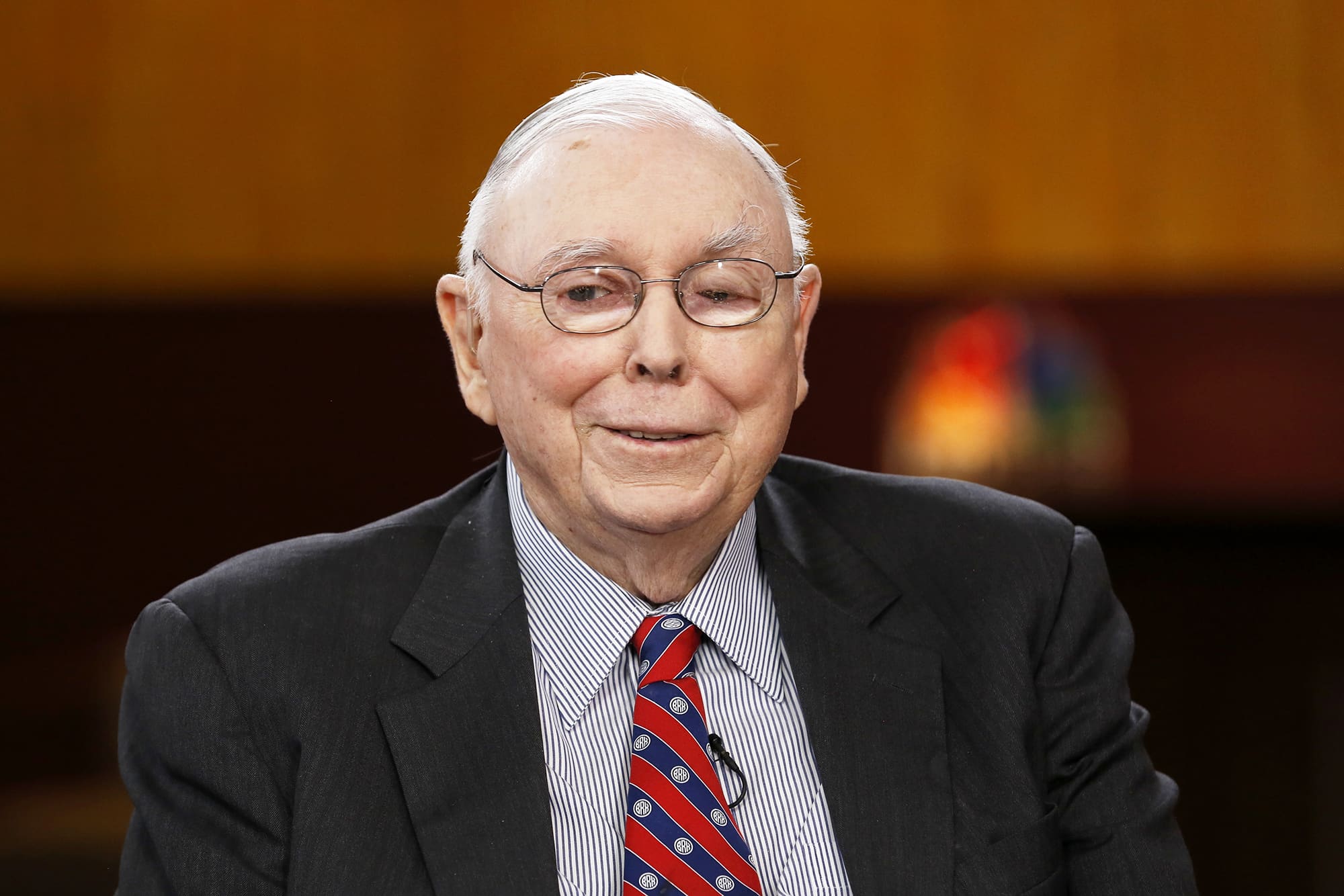

Charlie Munger is an American investor, businessman, and philanthropist. He is the vice chairman of Berkshire Hathaway, a conglomerate controlled by Warren Buffett. Munger is known for his wit and wisdom, and he has been a frequent speaker at investment conferences and business schools.

Munger is an agnostic, meaning that he does not believe in any gods. However, he has said that he is "a great admirer of the ethical system of Jesus." Munger has also said that he believes in the importance of "rationality, skepticism, and common sense."

Munger's religious views have influenced his investment philosophy. He believes that investors should be rational and skeptical, and they should not be swayed by emotional appeals. He also believes that investors should focus on the long term, and they should not try to time the market.

Charlie Munger Religion

Charlie Munger, the vice chairman of Berkshire Hathaway, is known for his wit and wisdom. He is also known for his agnostic religious views. Munger has said that he is "a great admirer of the ethical system of Jesus," but he does not believe in any gods. His religious views have influenced his investment philosophy, which emphasizes rationality, skepticism, and common sense.

- Agnostic

- Ethical

- Rational

- Skeptical

- Common sense

- Long-term

- Value investing

- Margin of safety

- Circle of competence

- Investment philosophy

Munger's religious views are reflected in his investment philosophy. He believes that investors should be rational and skeptical, and they should not be swayed by emotional appeals. He also believes that investors should focus on the long term, and they should not try to time the market. Munger's investment philosophy has been very successful, and he is considered one of the greatest investors of all time.

Agnostic

Agnosticism is the view that the existence of God or gods is unknown and perhaps unknowable. Agnostics neither affirm nor deny the existence of deities, but they often assert that a lack of evidence or a conflict of evidence prevents one from reaching a conclusion on the matter. This is Charlie Munger's view on religion.

- Munger's Agnosticism

Munger has said that he is "a great admirer of the ethical system of Jesus," but he does not believe in any gods. He believes that there is no evidence to support the existence of God, and he sees no reason to believe in something that cannot be proven. He also believes that it is important to focus on the things we can know and understand, rather than on things that are beyond our comprehension.

- Implications for Munger's Investment Philosophy

Munger's agnostic views have influenced his investment philosophy. He believes that investors should be rational and skeptical, and they should not be swayed by emotional appeals. He also believes that investors should focus on the long term, and they should not try to time the market. These principles have helped Munger to become one of the most successful investors of all time.

Munger's agnosticism is a reminder that it is possible to be a good person and a successful investor without believing in God. It is also a reminder that we should focus on the things we can know and understand, rather than on things that are beyond our comprehension.

Ethical

Charlie Munger is a strong believer in the importance of ethics in both business and personal life. He has said that "an ethical business is one that tries to do the right thing by its customers, employees, and the community." Munger believes that businesses should be honest, fair, and transparent, and that they should always put the interests of their stakeholders above their own.

- Integrity

Munger believes that integrity is the most important ethical value. He has said that "integrity is the bedrock of all good behavior." Munger believes that people with integrity are honest, trustworthy, and reliable. They keep their promises and do the right thing, even when it is difficult.

- Honesty

Munger believes that honesty is essential for building trust. He has said that "honesty is the best policy." Munger believes that people should be honest with themselves, with others, and with their customers. He believes that honesty is the foundation of all good relationships.

- Fairness

Munger believes that fairness is important for creating a just and equitable society. He has said that "fairness is giving people what they deserve." Munger believes that people should be treated fairly, regardless of their race, gender, religion, or sexual orientation. He believes that everyone should have the opportunity to succeed.

- Compassion

Munger believes that compassion is important for creating a caring and supportive society. He has said that "compassion is feeling the pain of others." Munger believes that people should care about each other and help those who are less fortunate. He believes that compassion is the foundation of all good deeds.

Munger's ethical beliefs have had a profound impact on his investment philosophy. He believes that investors should invest in companies that are ethical and have a strong track record of integrity, honesty, fairness, and compassion. Munger believes that these companies are more likely to be successful in the long run.

Rational

Charlie Munger's rational approach to investing is closely tied to his religious views. As an agnostic, Munger does not believe in the existence of any gods or supernatural beings. This leads him to rely on reason and logic when making investment decisions, rather than on faith or intuition.

- Critical Thinking

Munger is a strong advocate for critical thinking. He believes that investors should carefully evaluate all available information before making a decision. He is also skeptical of claims that cannot be supported by evidence.

- Objectivity

Munger strives to be objective in his investment decisions. He tries to avoid letting his personal biases or emotions influence his judgment. He also seeks out different perspectives and opinions before making a decision.

- Long-Term Perspective

Munger believes that investors should take a long-term perspective. He is not interested in making quick profits. Instead, he focuses on investing in companies that he believes have a strong future.

- Margin of Safety

Munger believes that investors should always leave a margin of safety in their investments. This means that they should only invest in companies that are trading at a discount to their intrinsic value. This helps to reduce the risk of losing money.

Munger's rational approach to investing has been very successful. He has been able to generate high returns for his investors over the long term. His approach is a reminder that investors should rely on reason and logic, rather than on faith or intuition, when making investment decisions.

Skeptical

Charlie Munger's skepticism is a key part of his investment philosophy. As an agnostic, Munger does not believe in the existence of any gods or supernatural beings. This leads him to be skeptical of claims that cannot be supported by evidence.

- Questioning Assumptions

Munger is always questioning assumptions. He is not willing to accept something as true simply because it is widely believed. He wants to see evidence to support any claim.

- Avoiding Confirmation Bias

Munger is aware of the tendency for people to seek out information that confirms their existing beliefs. He tries to avoid this bias by actively seeking out information that contradicts his beliefs.

- Looking for Evidence

Munger is always looking for evidence to support his investment decisions. He is not interested in making decisions based on hunches or intuition. He wants to see hard data that supports his thesis.

- Margin of Safety

Munger's skepticism leads him to always leave a margin of safety in his investments. This means that he only invests in companies that are trading at a discount to their intrinsic value. This helps to reduce the risk of losing money.

Munger's skepticism has been a key factor in his investment success. He has been able to generate high returns for his investors over the long term by avoiding the mistakes that many other investors make. His skepticism is a reminder that investors should always be questioning their assumptions and looking for evidence to support their investment decisions.

Common sense

Common sense is a fundamental component of Charlie Munger's religion. As an agnostic, Munger does not believe in any gods or supernatural beings. This leads him to rely on common sense and experience when making decisions, rather than on faith or intuition.

Munger defines common sense as "the product of experience and thought." He believes that common sense is essential for making sound judgments in all areas of life, including investing. Munger has said that "the most important thing in investing is not to lose money." He believes that common sense is the best way to avoid losing money.

Here are some examples of how Munger uses common sense in his investing decisions:

- He looks for companies with a long history of profitability.

- He avoids companies with a lot of debt.

- He invests in companies that he understands.

- He buys stocks at a discount to their intrinsic value.

Munger's common sense approach to investing has been very successful. He has been able to generate high returns for his investors over the long term. His approach is a reminder that investors should rely on common sense and experience, rather than on faith or intuition, when making investment decisions.

Long-term

Charlie Munger's religious views have a significant impact on his investment philosophy, including his emphasis on long-term investing. As an agnostic, Munger does not believe in any gods or supernatural beings. This leads him to focus on the here and now, rather than on the afterlife. He believes that the best way to achieve success in life is to focus on long-term goals and to avoid short-term thinking.

In the context of investing, Munger believes that investors should focus on buying and holding stocks of high-quality companies for the long term. He is not interested in making quick profits. Instead, he focuses on finding companies that have a strong track record of profitability and that are trading at a discount to their intrinsic value. He is willing to be patient and wait for these companies to grow in value over time.

Munger's long-term investment philosophy has been very successful. He has been able to generate high returns for his investors over the long term. His approach is a reminder that investors should focus on the long term and avoid short-term thinking. Patience is key to investment success.

Value investing

Value investing is an investment strategy that involves buying stocks of companies that are trading at a discount to their intrinsic value. Value investors believe that these stocks have the potential to generate high returns over the long term.

- Margin of safety

One of the key concepts in value investing is the margin of safety. This refers to the difference between the intrinsic value of a stock and its current market price. Value investors look for stocks with a wide margin of safety, as this provides a buffer against potential losses.

- Focus on intrinsic value

Value investors focus on the intrinsic value of a company, rather than its current market price. They believe that the intrinsic value of a company is determined by its future earnings potential. Value investors are willing to pay a fair price for a stock, but they are not willing to overpay.

- Long-term perspective

Value investing is a long-term investment strategy. Value investors are not interested in making quick profits. Instead, they focus on finding companies that have the potential to generate high returns over the long term.

- Patient investing

Value investors are patient investors. They are willing to hold stocks for long periods of time, even if the market is experiencing a downturn. They believe that the long-term potential of a company is more important than its short-term performance.

Value investing is a successful investment strategy that has been used by many of the world's most successful investors, including Warren Buffett and Charlie Munger. Value investing is consistent with Charlie Munger's religious views, which emphasize the importance of rationality, skepticism, and common sense. Value investors use these principles to identify stocks that are trading at a discount to their intrinsic value. They are patient investors who are willing to hold stocks for the long term. As a result, value investors have the potential to generate high returns over time.

Margin of safety

In the context of value investing, margin of safety refers to the difference between the intrinsic value of a stock and its current market price. It is a key concept in Charlie Munger's investment philosophy, which is influenced by his agnostic religious views.

- Importance of Margin of Safety

Munger believes that a margin of safety is essential for protecting against investment losses. He has said, "It's far better to buy a wonderful company at a fair price than a fair company at a wonderful price." This means that investors should be willing to pay a fair price for a stock, but they should not overpay. By buying stocks with a margin of safety, investors can reduce their risk of losing money.

- Calculating Margin of Safety

There are a number of ways to calculate the margin of safety of a stock. One common method is to compare the stock's current market price to its intrinsic value. Intrinsic value is the estimated value of a company based on its future earnings potential. If the stock's market price is significantly below its intrinsic value, then it is said to have a margin of safety.

- Margin of Safety in Practice

Munger has used the margin of safety concept to great success in his own investing career. He has invested in a number of companies that were trading at a discount to their intrinsic value, and he has generated high returns over the long term.

- Conclusion

The margin of safety is a key concept in Charlie Munger's investment philosophy. It is a way to protect against investment losses and to identify undervalued stocks. By using the margin of safety, investors can improve their chances of generating high returns over the long term.

Circle of competence

Charlie Munger's concept of the "circle of competence" is closely tied to his religious views. As an agnostic, Munger does not believe in any gods or supernatural beings. This leads him to focus on what he can know and understand, and to avoid areas where he lacks expertise. Munger's circle of competence is the area of knowledge and expertise in which he feels confident making investment decisions. He believes that investors should only invest in companies that they understand and that fall within their circle of competence.

There are a number of reasons why Munger's circle of competence is important. First, it helps to reduce the risk of making investment mistakes. When investors invest in companies that they do not understand, they are more likely to make poor decisions. Second, it helps investors to focus their time and resources on the areas where they have the most expertise. Third, it helps investors to avoid the temptation to follow the herd and invest in popular stocks that may be overvalued.

There are a number of ways to identify your circle of competence. One way is to consider your education, training, and experience. Another way is to consider your interests and hobbies. Whatever your circle of competence is, it is important to stick to it when making investment decisions.

Here are some examples of how Munger has applied his circle of competence to his own investing career:

- Munger has a background in law and accounting. This has given him a deep understanding of the financial statements of companies. As a result, he is able to identify companies that are undervalued and that have a strong financial foundation.

- Munger is also a voracious reader. He spends a lot of time reading about different industries and companies. This has given him a broad knowledge of the business world. As a result, he is able to identify companies that have a competitive advantage and that are likely to succeed over the long term.

- Munger is a patient investor. He is willing to hold stocks for long periods of time, even if the market is experiencing a downturn. This has allowed him to generate high returns over the long term.

Munger's circle of competence is a key part of his investment philosophy. It has helped him to generate high returns over the long term. It is also a reminder that investors should focus on what they know and understand, and to avoid areas where they lack expertise.

Investment philosophy

Charlie Munger's investment philosophy is closely tied to his religious views. As an agnostic, Munger does not believe in any gods or supernatural beings. This leads him to focus on what he can know and understand, and to avoid areas where he lacks expertise. Munger's investment philosophy is based on the principles of rationality, skepticism, and common sense. He believes that investors should focus on the long term and avoid short-term thinking. He also believes that investors should only invest in companies that they understand and that fall within their circle of competence.

Munger's investment philosophy has been very successful. He has been able to generate high returns for his investors over the long term. His approach is a reminder that investors should focus on the fundamentals of investing and avoid following the herd.

Here are some of the key insights from Munger's investment philosophy:

- Focus on the long term.

- Avoid short-term thinking.

- Only invest in companies that you understand.

- Stick to your circle of competence.

- Be patient.

- Be skeptical.

- Use common sense.

By following these principles, investors can improve their chances of generating high returns over the long term.

FAQs by "charlie munger religion"

This section addresses frequently asked questions related to Charlie Munger's religious views and their influence on his investment philosophy.

Question 1: What are Charlie Munger's religious beliefs?

Charlie Munger is an agnostic, meaning that he does not believe in the existence of any gods or supernatural beings. He has said that he is "a great admirer of the ethical system of Jesus," but he does not believe in the divinity of Christ.

Question 2: How do Munger's religious beliefs influence his investment philosophy?

Munger's agnostic views lead him to rely on reason and logic when making investment decisions, rather than on faith or intuition. He is also skeptical of claims that cannot be supported by evidence. These principles have helped Munger to develop a successful investment philosophy that emphasizes rationality, skepticism, and common sense.

Question 3: What is Munger's "circle of competence"?

Munger's "circle of competence" is the area of knowledge and expertise in which he feels confident making investment decisions. He believes that investors should only invest in companies that they understand and that fall within their circle of competence. This helps to reduce the risk of making investment mistakes.

Question 4: What are some of the key insights from Munger's investment philosophy?

Some of the key insights from Munger's investment philosophy include: focusing on the long term, avoiding short-term thinking, only investing in companies that you understand, sticking to your circle of competence, being patient, being skeptical, and using common sense.

Question 5: How has Munger's investment philosophy been successful?

Munger's investment philosophy has been very successful. He has been able to generate high returns for his investors over the long term. His approach is a reminder that investors should focus on the fundamentals of investing and avoid following the herd.

Question 6: What are some of the criticisms of Munger's investment philosophy?

One criticism of Munger's investment philosophy is that it is too focused on the long term. Some investors believe that it is possible to generate high returns in the short term by taking on more risk. Another criticism is that Munger's philosophy is too conservative. Some investors believe that it is possible to generate higher returns by investing in more speculative companies.

Summary: Charlie Munger's agnostic religious views have had a significant impact on his investment philosophy. He emphasizes rationality, skepticism, and common sense, and he believes that investors should focus on the long term and avoid short-term thinking. Munger's investment philosophy has been very successful, and it is a reminder that investors should focus on the fundamentals of investing and avoid following the herd.

Transition to the next article section: Charlie Munger is a fascinating investor with a unique perspective on the world. His religious views have had a significant impact on his investment philosophy, and he has been able to generate high returns for his investors over the long term. In the next section, we will take a closer look at Munger's investment philosophy and discuss some of the key insights that investors can learn from him.

Tips for Investors from Charlie Munger's Religious Views

Charlie Munger's agnostic religious views have led him to develop a unique investment philosophy that emphasizes rationality, skepticism, and common sense. Here are five tips that investors can learn from Munger's religious views:

Tip 1: Focus on the long term.

Munger believes that investors should focus on the long term and avoid short-term thinking. He has said that "the stock market is a device for transferring money from the impatient to the patient." By focusing on the long term, investors can avoid the temptation to make impulsive decisions based on short-term market fluctuations.

Tip 2: Be skeptical.

Munger is skeptical of claims that cannot be supported by evidence. He has said that "it's better to be roughly right than precisely wrong." Investors should be skeptical of investment advice that sounds too good to be true. They should also be skeptical of their own assumptions and biases.

Tip 3: Use common sense.

Munger believes that investors should use common sense when making investment decisions. He has said that "common sense is the most important thing in investing." Investors should avoid investing in companies that they do not understand or that seem too risky. They should also be aware of their own limitations and seek professional advice when necessary.

Tip 4: Invest in companies that you understand.

Munger believes that investors should only invest in companies that they understand. He has said that "it's better to know a little about a lot of companies than a lot about a few companies." Investors should do their own research and only invest in companies that they feel comfortable with.

Tip 5: Stick to your circle of competence.

Munger believes that investors should stick to their circle of competence. He has said that "it's better to be a big fish in a small pond than a small fish in a big pond." Investors should focus on investing in areas where they have expertise and experience. They should avoid investing in areas that they do not understand.

Summary: By following these tips, investors can improve their chances of generating high returns over the long term. Munger's religious views have led him to develop a unique investment philosophy that emphasizes rationality, skepticism, and common sense. Investors can learn a lot from Munger's approach and use it to improve their own investment decisions.

Transition to the article's conclusion: Charlie Munger is a fascinating investor with a unique perspective on the world. His religious views have had a significant impact on his investment philosophy, and he has been able to generate high returns for his investors over the long term. In the next section, we will take a closer look at Munger's investment philosophy and discuss some of the key insights that investors can learn from him.

Conclusion

Charlie Munger's agnostic religious views have had a profound impact on his investment philosophy. He emphasizes rationality, skepticism, and common sense, and he believes that investors should focus on the long term and avoid short-term thinking. Munger's investment philosophy has been very successful, and it is a reminder that investors should focus on the fundamentals of investing and avoid following the herd.

Munger's religious views have also led him to develop a unique set of investment principles. These principles include: focusing on the long term, being skeptical, using common sense, investing in companies that you understand, and sticking to your circle of competence. By following these principles, investors can improve their chances of generating high returns over the long term.

Unlock The Age Mystery: Unraveling Mike Thomas's Journey And Legacy

Unveil Culinary Delights: Garden Of Eve's Sustainable And Innovative Haven In San Diego

Unveiling The Genius Of Amanda Caravallah: Data Science Pioneer For Financial Frontiers

ncG1vNJzZmilmajAdnrApqpsZpSetKrAwKWmnJ2Ro8CxrcKeqmebn6J8pLTAq6OinV2iwq%2BzxKtkq52cnrSqu81nn62lnA%3D%3D